Managing money in India used to mean writing expenses in a diary, checking bank passbooks, or waiting for SMS alerts to know your balance. But in today’s fast-moving digital world – with UPI payments, online banking, and cashless transactions – Indians need faster, smarter, and more automated ways to manage their finances.

That’s why Personal Finance Management (PFM) apps are becoming the go-to solution in 2025. These apps automatically track your spending, plan budgets, remind you of bills, show real-time cash flow, and even help you build savings or credit – all from one mobile dashboard. In this blog, we have covered the list of the Top 10 PFM Apps in India for 2025, along with their features, benefits, ideal users, and how to choose the right one for your financial goals.

Traditional Money Management vs PFM Apps

| Aspect | Old/Manual Method | Modern PFM Apps (2025) |

|---|---|---|

| Expense Tracking | Manual diary / Excel entry | Auto-tracks via SMS, UPI & bank sync |

| Budget Planning | Hard to follow, no alerts | Visual budgets, smart tracking |

| Bill & EMI Reminders | Easily forgotten | Instant app notifications |

| Account Overview | Check each bank separately | All accounts/cards in one dashboard |

| Insights | Requires time & calculations | Auto-generated analytics & reports |

| Security & Backup | No data protection | Bank-level encryption & cloud backup |

| Time & Effort | High effort, low accuracy | Quick, automatic & stress-free |

TOP 10 PERSONAL FINANCE MANAGEMENT APPS IN INDIA [2025]

1. AXIO

AXIO is a trusted Indian Personal Finance Management (PFM) app that helps you stay in control of your money from tracking every expense automatically to reminding you of upcoming bills.

Primary Goal:

- Simplify expense tracking and budgeting in one place.

Key Features:

- Auto expense tracking via SMS

- Smart bill reminders

- Easy budget setup and insights

- Secure and private data handling

Ideal For:

- Salaried individuals

- Business professionals who want a simple, automatic, and stress-free way to manage their finances.

AXIO makes money management effortless – track, plan, and save smarter every day.

2.Moneyview – Your Smart Pocket Finance Partner

Say goodbye to messy spreadsheets and hello to effortless money management! Moneyview is your all-in-one personal finance buddy that tracks every rupee you spend, builds smart budgets, checks your credit score for free, and even offers instant personal loans when you need a quick boost.

Primary Objective:

- Make personal finance simple, smart, and stress-free.

Key Features:

- Auto expense tracking straight from your SMS alerts

- Free credit score check anytime, anywhere

- Instant personal loans in just a few taps

Ideal For:

- Beginners

- Salaried professionals who want to stay on top of their finances without the fuss.

Your money, your view… powered by Moneyview.

3.ET Money : Your All-in-One Wealth & Finance Companion

Take charge of your money like never before with ET Money, the intelligent finance app that helps you track expenses, invest smartly, and manage insurance effortlessly all in one sleek platform.

Primary Objective:

Empower users to invest, save, and manage money with confidence.

Key Features:

- Easy mutual fund investments tailored to your goals

- Smart insurance management under one dashboard

- Timely bill reminders so you never miss a payment

- Handy tax-saving tools to make every rupee count

Ideal For:

- Investors

- salaried professionals who want to grow, protect, and organize their wealth — the smart way.

With ET Money, your financial journey becomes simpler, smarter, and more rewarding.

4.CASHe – Because Sometimes, You Just Need a Little Extra

We’ve all been there that unexpected bill, a weekend plan, or just a mid-month crunch. CASHe understands. It’s a friendly digital lending app that helps you get quick credit without endless paperwork or stress. Plus, its smart SMS reader quietly tracks your spending so you always know where your money’s going.

Primary Objective:

- Make borrowing simple, fast, and genuinely helpful for everyday needs.

Key Features:

- Buy Now, Pay Later (BNPL) for both online and offline shopping

- Credit-building tools to strengthen your financial score

- Instant personal loans, approved in minutes

Ideal For:

- Anyone who needs quick, trustworthy credit support!! no drama, just help when you need it most.

With CASHe, borrowing feels less like a hassle and more like having a friend who’s got your back.

5. GOODBUDGET – Budgeting Made Simple, Together

Meet Goodbudget, the digital version of your grandma’s tried-and-true envelope method but smarter. It helps you plan where every rupee goes, track your spending, and stay accountable, all while keeping your loved ones in sync.

Primary Objective:

- Help you plan, track, and stick to your budget with mindful spending.

Key Features:

- Digital envelope budgeting that makes saving fun and visual

- Sync budgets across family devices to stay on the same page

- Cross-platform access, use it on mobile or desktop, anytime

Ideal For:

- Families

- individuals who love to stay in control of their money and prefer hands-on budgeting.

With Goodbudget, it’s not just about tracking expenses it’s about building healthy money habits, together.

6. POCKET GUARD – Know What’s Really in Your Pocket

If you’ve ever wondered “Can I actually afford this?” PocketGuard has your answer. This simple, no-fuss budgeting app shows exactly how much money you have left after bills, goals, and savings, so you can spend with confidence and save smarter.

Primary Objective:

- Help users avoid overspending and make saving effortless.

Key Features:

- “In My Pocket” view you can see your true spendable balance instantly

- Bill and subscription tracking to prevent surprise charges

- Debt payoff planner to help you stay on top of repayments

Ideal For:

- Anyone who struggles to control spending, juggles multiple accounts, or just wants a clear picture of their money.

With PocketGuard, you don’t just track money, you take control of it.

7. Finanjo- Don’t Just Spend, Understand.

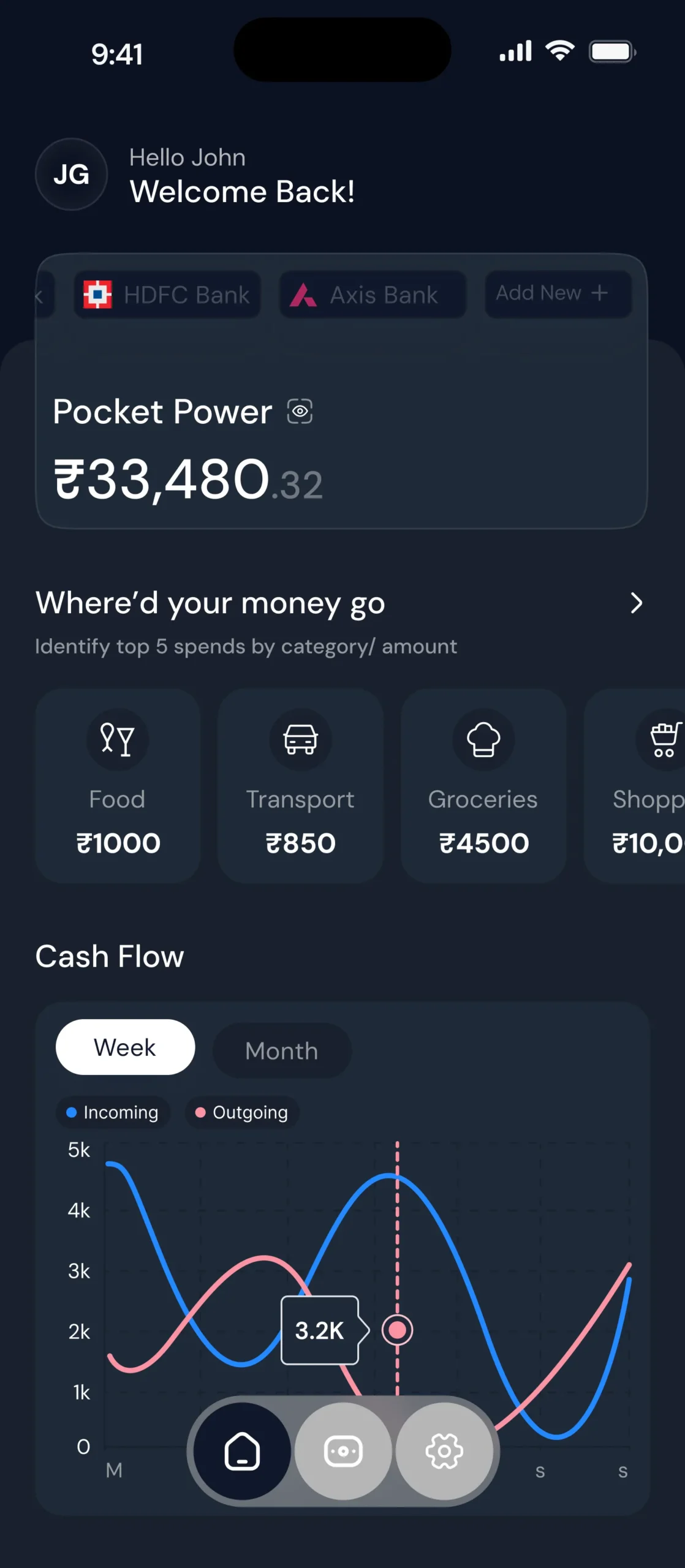

Finanjo is a personal finance management (PFM) app designed specifically for Indian users. It enables you to track expenses, monitor cash flow, and gain clear insights into your finances, all within a single app. We are a fintech startup headquartered in Jaipur, India, committed to making money management transparent, secure, and straightforward. Our mission is to empower individuals to take control of their financial lives, supported by tools built to the highest standards of privacy, security, and regulatory compliance.

Primary Objective:

- Help you see exactly where your money goes, get smart insights on your spending, and take control of your finances.

Key Features of Finanjo:

- Securely connect all your bank accounts, cards, and financial instruments via the RBI-approved Account Aggregator framework.

Finanjo - Spend Analysis & Cash Flow Dashboard: get detailed breakdowns like “Food & Dining ₹12,400”, “Shopping ₹8,200”, plus net cash flow comparisons vs last month.

Finanjo - Best Card to Pay: suggestions on which card gives you optimal rewards or cashback for a purchase.

- Recurring Expense Tracking: see subscriptions, memberships, bills in one place so you’re not caught off-guard.

- Top-tier security & privacy: Data is shared only when user give consent and secured.

Ideal Users:

- Salaried professionals or anyone with multiple bank cards/accounts wanting a unified view.

- People who want automatic insights rather than manual budget tracking.

- Users in India, since the app is built around Indian financial habits and Indian banking frameworks.

Why it stands out:

- It’s more than just expense tracking, it gives actionable insights (e.g., “use this card here”, “you’re overspending in this category”).

- The linking of all accounts means fewer manual entries and more automated intelligence.

- Built for India (Jaipur-based startup) so it suits local financial behaviour and regulations

8.You Need A Budget (YNAB) – Give Every Rupee a Purpose

YNAB isn’t just a budgeting app … it’s a mindset shift. It helps you plan for the future, break free from paycheck-to-paycheck stress, and make every rupee count. With its powerful zero-based budgeting system, you’ll know exactly where your money is going and why.

Primary Objective:

- Help users create a proactive, goal-driven budget where every rupee has a clear job.

Key Features:

• Zero-based budgeting to assign purpose to every bit of income

• Goal tracking to stay focused on what truly matters

• Seamless bank integration for real-time financial updates

Ideal For:

- Individuals who crave structure, want to plan ahead, and aim for long-term financial freedom.

With YNAB, you don’t just budget, you build a life of clarity, control, and confidence.

9. BUDGET BY REALBYTE

Budget by Realbyte – Simple, Visual, and Totally Yours

If you love keeping things hands-on, Budget by Realbyte is your go-to budgeting companion. It’s designed for people who enjoy tracking their finances manually with clean visuals, customizable categories, and complete control over every entry.

Primary Objective:

- Make budgeting simple and visual through easy tracking and personalization.

Key Features:

- Manual expense entry for full awareness of your spending

- Visual charts and reports that make money tracking fun and clear

- Export to Excel for deeper analysis and long-term tracking

Ideal For:

- Students, young professionals, and anyone with irregular income who prefers a more mindful, manual approach to budgeting.

With Budget by Realbyte, your money story is written by you, one smart choice at a time.

10. WALLET -Your Global Money Tracker

Wherever life takes you, Wallet keeps your finances organized. This international budgeting app helps you track expenses, manage multiple accounts, and plan budgets seamlessly whether you’re spending in rupees, dollars, or euros.

Primary Objective:

- Offer flexible money tracking through manual entries or connected bank accounts.

Key Features:

- Supports multiple currencies — perfect for global travelers

- Multiple account management for a clear financial overview

- Smart budgeting tools to plan, track, and stay in contron

Ideal For:

- Global users who want an easy, visually clear way to manage money across countries and accounts.

With Wallet, your finances stay connected — no matter where you are in the world.

➢ CHOOSING THE RIGHT FINANCE APP

When it comes to managing your money, the best app depends on what you need whether it’s budgeting, borrowing, or investing. Here’s a creative and practical breakdown to help you pick your perfect match:

A] BUDGETING-FOCUSED APPS

| App | Pros | Cons |

|---|---|---|

| GoodBudget | Uses the envelope budgeting system, syncs across devices | No auto bank linking; manual entry only |

| YNAB (You Need A Budget) | Zero-based budgeting, strong financial tracking, great educational resources | Paid subscription required |

| Budget by Realbyte | Easy expense tracking, calendar view, receipt-saving | Slightly complex for beginners |

| Wallet | Intuitive interface, real-time syncing, supports multiple currencies | Limited investment features |

| PocketGuard | Tracks bills, shows real “spendable” balance, highly secure | Fewer customization options |

| Finanjo | Indian-made, connects all bank accounts & cards, best card suggestions |

B] LOAN / CREDIT-FOCUSED APPS

| App | Pros | Cons |

|---|---|---|

| AXIO | Tracks expenses, offers bill and credit card reminders | Limited investment options |

| Moneyview | Instant personal loans, UPI payments, credit score tracking | Interface can feel a bit cluttered |

| CASHe | Instant short-term loans, minimal documentation | Only offers credit; lacks budgeting tools |

C] INVESTMENT-FOCUSED APPS

| App | Pros | Cons |

|---|---|---|

| ET Money | Mutual fund investments, SIP tracking, insurance, and tax-saving tools | Can be overwhelming for beginners, some advanced features may require subscription (Genius) |

Why are PFM apps gaining popularity in India?

• Tracking expenses: These apps automatically record every expense for you, so at the end of the month you know where your money went, and you can plan for the next month accordingly.

• Budgeting becomes fun: With instant alerts, visual graphs, and easy categorization, keeping a check on your expenses feels less like a chore and more like a game.

• Intuitive interface: PFM apps are designed with simple and user-friendly interfaces, making them easy to use for a large audience.

• Reduce hustle: Eliminate the need for physical visits to bank branches.

• Digital India is making it easy: These apps are directly linked to your bank accounts and UPI, therefore no messy calculations or paperwork required.

FAQs: Track Your Expenses and Budget Smartly – 2025’s Best Personal Finance Apps

1. Why use a finance app in 2025?

Because managing money is easier when your phone does the math. Finance apps help you track expenses, plan budgets, and save smarter without stress.

2. Which app is best to track daily expenses?

Finanjo and AXIO are great picks. They automatically track spending, send bill reminders, and keep everything in one place.

3. Are these PFM apps safe to use?

Yes, trusted apps like ET Money and Finanjo use bank-level security to protect your data. Just make sure you download them from official stores.

4. Can I link my bank account in PFM apps?

Absolutely. Most apps let you connect your bank or UPI to track every rupee automatically.

5. How do budgeting apps help save money?

They show where your money really goes and set spending limits, so you stay mindful and save without even realizing it.

6. What’s special about Finanjo PFM app?

Finanjo gives real-time money insights, auto expense tracking, and smart budget tips – perfect for anyone who wants to handle money confidently.

7. Can I manage family budgets too?

Yes. Some apps like GoodBudget let families sync accounts and plan spending together easily.

8. Do these apps work offline?

Many apps allow offline entry for expenses, but features like bank syncing and cloud backups need internet access.

9. Can I track loans, EMIs, and subscriptions?

Yes. Apps like Finanjo and AXIO help you monitor EMIs, recurring bills, and subscriptions so you never miss a payment.

10. Are there free finance apps for beginners?

Yes. GoodBudget, PocketGuard, and Finanjo offer free versions that are easy to use and great for starting your budgeting journey.

CONCLUSION

Money management isn’t just about numbers, it’s about understanding your habits and goals.

The right finance app doesn’t just track expenses; it teaches you about your relationship with money.

Choose the one that matches your rhythm, not the one with the most features.

Because the best finance app isn’t the one that does everything

it’s the one that helps you grow smarter, save better, and live stress-free.

Leave a Reply