Two conventional banking tools that are frequently used for safe and dependable payment processing are Cheque vs Demand Draft. Despite being widely used for money transfers, they operate very differently in terms of processing, charges, usage, and payment assurance. Students, professionals, and business owners who wish to select the safest and most practical method for their transactions should be aware of these distinctions. We have explained the main distinctions between a demand draft and a check in this blog post so you can choose the one that best meets your financial requirements.

What Is a Cheque?

A cheque is a written, signed instrument that instructs a bank to pay a specific amount of money from the account holder’s bank account to another person or entity. It is one of the oldest and most commonly used non-cash payment methods in the banking system.

A cheque is a negotiable instrument issued by an account holder, directing their bank to pay a certain sum to the person named on the cheque or to the bearer. It serves as a safe way to make payments without carrying physical cash.

Parties Involved in a Cheque

A cheque transaction typically involves three key parties:

1. Drawer

-

The person who writes and signs the cheque.

-

The drawer must have an active bank account and sufficient funds.

2. Drawee

-

The bank responsible for processing the cheque and releasing the payment.

-

The drawer’s bank is always the drawee.

3. Payee

-

The person or organization to whom the payment is to be made.

-

The payee can be an individual, a company, or even the drawer (in case of self-cheques).

Common Uses of Cheques

Cheques are widely used for:

-

Salary payments by employers

-

Personal transactions (rent, school fees, medical bills)

-

Business payments to suppliers

-

Refunds and reimbursements

-

Transferring large amounts safely without cash

-

Account-to-account transfers (e.g., self-cheque)

What Is a Demand Draft (DD)?

A Demand Draft (DD) is a prepaid negotiable instrument issued by a bank, guaranteeing payment to the person or organisation named on it. Unlike a cheque, the amount is paid in advance, which means a demand draft cannot be dishonoured due to insufficient funds.

A demand draft is a secure payment instrument issued by a bank, directing another branch (or the same branch) to pay a fixed amount to a specified payee. It is commonly used when guaranteed and risk-free payment is required.

How a Demand Draft Works

-

The customer approaches a bank (their own or any bank).

-

Pays the required amount in advance (cash, account debit, or cheque).

-

The bank issues the DD in favour of the payee.

-

The payee deposits the DD in their bank, and the bank processes the payment.

-

Since the bank already holds the funds, the payment is assured.

This makes DDs a safer alternative to cheques, especially for high-value or sensitive transactions.

Who Issues a Demand Draft?

A demand draft is always issued by a bank, not by an individual.

The bank guarantees the payment, which eliminates the risk of defaults.

When Is a Demand Draft Used?

Demand drafts are commonly used in situations where secure, guaranteed payment is required:

-

College or university admission fees

-

Government exam fees

-

Business-to-business (B2B) payments

-

Booking fees (travel, hotels, real estate)

-

High-value transactions

-

Payments across cities or states

-

When the payer and payee do not know each other well

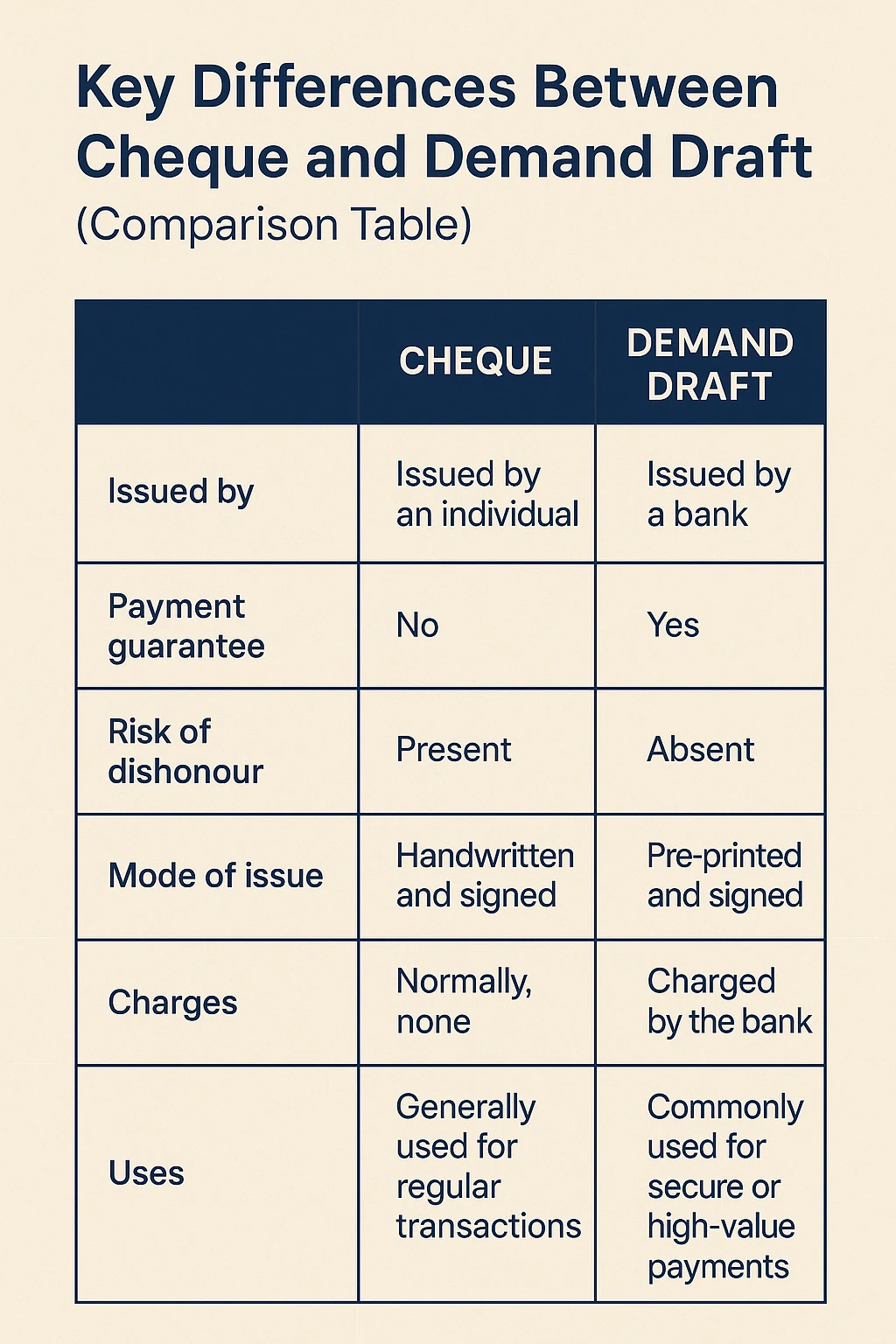

Key Differences Between Cheque and Demand Draft

| Point of Comparison | Cheque | Demand Draft (DD) |

|---|---|---|

| Issued by | Issued by an individual account holder | Issued only by a bank |

| Payment guarantee | Not guaranteed; depends on drawer’s account balance | Fully guaranteed; amount is prepaid |

| Risk of dishonour | High – can bounce due to insufficient funds, signature mismatch, overwriting, etc. | None – cannot be dishonored since money is paid upfront |

| Mode of issue | Handwritten and signed by the account holder | Pre-printed and signed by the bank |

| Charges | Usually no charges for issuing a cheque | Bank charges a fee for issuing a DD |

| Uses | General payments like rent, bills, salary, refunds, or regular transactions | Secure or high-value payments such as fees, government payments, B2B transactions, bookings, and when parties need payment assurance |

How a Cheque Works ?

A cheque works as a written instruction from the account holder (drawer) asking the bank (drawee) to pay a specific amount to the person or entity named on the cheque (payee). Once issued, it goes through a clearing process before the money is transferred.

1. Types of Cheques

Here are the most commonly used types:

-

Bearer Cheque

Payable to the person who presents it at the bank.

High risk if lost, as anyone can encash it.

-

Order Cheque

Payable only to the person whose name is written on the cheque.

-

Crossed Cheque

Has two parallel lines (//) on the top left.

Cannot be encash directly—must be deposited in a bank account.

-

Account Payee Cheque (A/C Payee)

Payment must go only to the payee’s bank account—highest safety.

-

Post-Dated Cheque

Dated for a future date; can be deposited only on or after that date.

-

Self Cheque

Drawer writes “Self” to withdraw money from their own account.

2. Clearing Process (How a Cheque Gets Paid)

-

Payee deposits the cheque in their bank.

-

The cheque is sent to the clearing house (RBI/NPCI system).

-

The drawer’s bank verifies:

-

Signature

-

Funds availability

-

Overwriting

-

Date validity

-

-

If everything is correct, the amount is debited from the drawer’s account.

-

The money is credited to the payee’s account.

This process usually takes 1–2 working days, depending on banks and location.

3. Risks of Cheque Bouncing

A cheque may “bounce” or get dishonored if:

-

Insufficient funds

-

Signature mismatch

-

Overwriting or corrections

-

Wrong date (post-dated or stale cheque)

-

Damaged cheque

-

Mismatch in amount (words vs numbers)

Cheque bounce charges are applied on both parties, and legal action may follow under the NI Act, 1881 (in some cases).

How a Demand Draft Works ?

A Demand Draft (DD) is a prepaid, bank-issued instrument. Since the customer pays the amount in advance, the bank guarantees payment.

1. A DD(Demand Draft) Is Prepaid

Unlike a cheque where funds are deducted later, a DD is issued only after the customer:

-

Pays cash, or

-

Authorizes bank to debit their account

This ensures the bank already holds the money before issuing the draft.

2. No Risk of Bounce

A DD cannot be dishonored, because:

-

The bank has already taken the money

-

The bank itself is responsible for making the payment

This makes demand drafts safer than cheques for important or high-value transactions.

3. Common Uses of a Demand Draft

Demand drafts are widely used when the payee requires secure, guaranteed payment, such as:

-

Entrance exam fees

-

College/university admission fees

-

Government payments

-

Business-to-business (B2B) transactions

-

Security deposits

-

Booking amounts (travel, hotels, real estate)

-

Outstation payments (across cities or states)

Types of Cheques

Cheques come in several types based on how the payment is made and who is allowed to receive it. Here are the most commonly used types:

1. Bearer Cheque

A cheque payable to the person who presents (bears) it at the bank.

-

Can be encashed immediately.

-

High risk if lost, as anyone can withdraw the amount.

2. Order Cheque

A cheque payable only to the person whose name is written on it.

-

More secure than bearer cheques.

-

Bank verifies the identity of the payee before payment.

3. Crossed Cheque

Has two parallel lines (//) drawn on the cheque.

-

Cannot be encashed at the counter.

-

Must be deposited into a bank account.

-

Provides added safety.

4. Post-Dated Cheque

A cheque with a future date written on it.

-

Can be deposited only on or after the date mentioned.

-

Often used for EMI payments or scheduled payments.

5. Self Cheque

A cheque where the drawer writes “Self” as the payee.

-

Used to withdraw cash from the drawer’s own bank account.

Types of Demand Drafts

Demand drafts also come in various forms depending on when and how the payment is made.

1. Sight Draft

A draft payable immediately on presentation.

-

The bank releases the payment as soon as the payee submits the DD.

2. Time Draft

A draft payable after a specific period (e.g., 30 or 60 days).

-

Used when payment is to be made after a fixed credit period.

3. Crossed Demand Draft

Has two parallel lines (//), similar to a crossed cheque.

-

Cannot be encashed directly.

-

Must be deposited into the payee’s bank account.

-

Provides higher safety.

4. Banker’s Draft

A type of demand draft issued by a bank on behalf of the customer.

-

Considered highly secure because the payment is guaranteed by the issuing bank.

-

Often used for large transactions or official payments.

Advantages and Disadvantages of Cheques and Demand Drafts

| Instrument | Advantages | Disadvantages |

|---|---|---|

| Cheque |

|

|

| Demand Draft (DD) |

|

|

When Should You Use a Cheque and a Demand Draft?

| Situation | Use a Cheque | Use a Demand Draft (DD) |

|---|---|---|

| Payment Type | Routine payments like rent, bills, refunds, or business transactions | High-value or sensitive payments where guaranteed clearance is needed |

| Assurance Required | When payment assurance is not critical | When the payee wants guaranteed payment with no chance of bounce |

| Cost Factor | Best when you want a free payment method | Used even with fees, if payment security is more important |

| Convenience | Issued easily from your cheque book anytime | Requires visiting a bank or applying online to issue a DD |

| Common Uses | Personal payments, vendor payments, salary, reimbursements | Exam fees, college admission, government fees, deposits, B2B payments |

| Risk Factor | Risk of bounce if funds are insufficient or signature mismatch | Zero bounce risk because DD is prepaid |

Cheque vs DD: Which Is Better in 2025?

| User Type | Cheque – When It’s Better | Demand Draft (DD) – When It’s Better |

|---|---|---|

| Students | Suitable for small payments like hostel fees, rent, or daily needs if the receiver accepts cheques | Best for exam fees, college admissions, scholarship deposits, or anywhere secure prepaid payment is required |

| Business Owners | Ideal for regular vendor payments, salaries, reimbursements, and routine business transactions | Better for high-value, inter-city, or sensitive transactions where payment failure could cause issues |

| Government Payments | Accepted in some cases, but not always preferred due to risk of bounce or delay | Highly preferred because government departments require guaranteed, non-bounceable payments |

FAQs – Cheque vs Demand Draft (DD)

1. What is the main difference between a cheque and a demand draft?

A cheque is issued by an individual and may bounce if funds are insufficient, while a demand draft is issued by a bank and is prepaid, meaning it cannot be dishonoured.

2. Can a demand draft be cancelled?

Yes, a demand draft can be cancelled, but only by the person who purchased it. You must submit the original DD and a written request to the issuing bank. Cancellation charges apply.

3. How long does a cheque take to clear?

Cheques usually take 1–2 working days to clear. Outstation cheques may take longer depending on the bank and location.

4. Is there any chance of a demand draft bouncing?

No. A demand draft cannot bounce because the amount is paid upfront before the bank issues it.

5. Are there charges for issuing a demand draft?

Yes. Banks charge a fee based on the amount of the draft and whether it is payable locally or at an outstation branch.

6. Which is safer – cheque or demand draft?

A demand draft is safer because the bank guarantees payment. Cheques can be lost, forged, or dishonoured if funds are insufficient.

7. Can I issue a cheque without maintaining a minimum balance?

You can write a cheque, but if the balance is insufficient at the time of clearing, the cheque will bounce, and charges will apply.

8. When should I prefer a demand draft over a cheque?

Use a demand draft when:

-

Payment must be guaranteed

-

You’re paying exam fees, college fees, deposits

-

You want to avoid the risk of cheque bounce

-

You are paying across cities/states

9. Can a cheque be used for high-value payments?

Yes, but it carries the risk of dishonour. For large or critical payments, a demand draft is the safer option.

10. Are cheques still used in 2025?

Yes. Cheques are still used, especially for rent, refunds, business payments, and personal transactions, though digital payments have become more popular.

Conclusion

Demand drafts (DDs) and Cheque are both crucial to financial transactions, but they have different functions. For routine payments like rent, bills, and business transactions where convenience is more important than complete security, a cheque is the best option. A demand draft, on the other hand, works best for sensitive or high-value payments that need to be cleared with certainty and without the possibility of dishonor.

The degree of payment assurance, urgency, and risk involved will determine which option is best. Cheque are easy and affordable for regular transactions, but demand drafts provide unparalleled security and dependability for payments pertaining to government, education, and official business. You can make safer and more informed financial decisions if you are aware of these distinctions.

Leave a Reply