Knowing the documents required for education loan is the first step toward getting quick and hassle-free approval for your higher studies. Many students face delays or rejections simply because they aren’t aware of the complete paperwork banks expect in 2025. To avoid this confusion and speed up your loan process, it’s important to understand exactly what lenders look for.

This blog is structured to provide you with everything you need to apply for an education loan without any difficulty. You will find all the information necessary for completing your education loan application in an easy-to-follow step-by-step guide. Whether you are interested in an education loan for studies in India or overseas, you will find all the key details needed to complete your application quickly and confidently.

Types of Education Loans

Before diving into the paperwork, it’s important to understand the different types of education loans available. Each category has slightly different eligibility criteria and documentation needs, so knowing your loan type helps you prepare better.

1. Domestic Education Loan

A domestic education loan is offered to students who plan to pursue their studies within India. These loans usually require basic student documents, academic records, admission confirmation, and the co-applicant’s income proof. Since the fees are relatively lower than international universities, the documentation process is also simpler and quicker.

2. Study Abroad Education Loan

A study abroad loan covers tuition fees, travel, accommodation, and living expenses for students planning to study overseas. Banks and NBFCs demand additional documents like a passport, visa, offer letter, and foreign currency estimates. The approval process is stricter because the loan amount is typically higher.

3. Collateral vs. Non-Collateral Loans

- Collateral Education Loan: These loans are secured against property, fixed deposits, or other assets. They require extensive property documents, ownership proof, valuation reports, and legal clearances. Collateral loans usually offer higher loan amounts and lower interest rates.

- Non-Collateral Education Loan: These are unsecured loans where no property is needed. They are based on the student’s profile, co-applicant’s income, and academic potential. Documentation is simpler, but banks may require stronger income proof or a guarantor.

Why Document Requirements Differ ?

Document requirements change depending on factors like the loan amount, the student’s study destination, the parent’s income stability, and whether collateral is involved. High-value or international loans require more verification, while domestic and non-collateral loans have comparatively lighter paperwork.

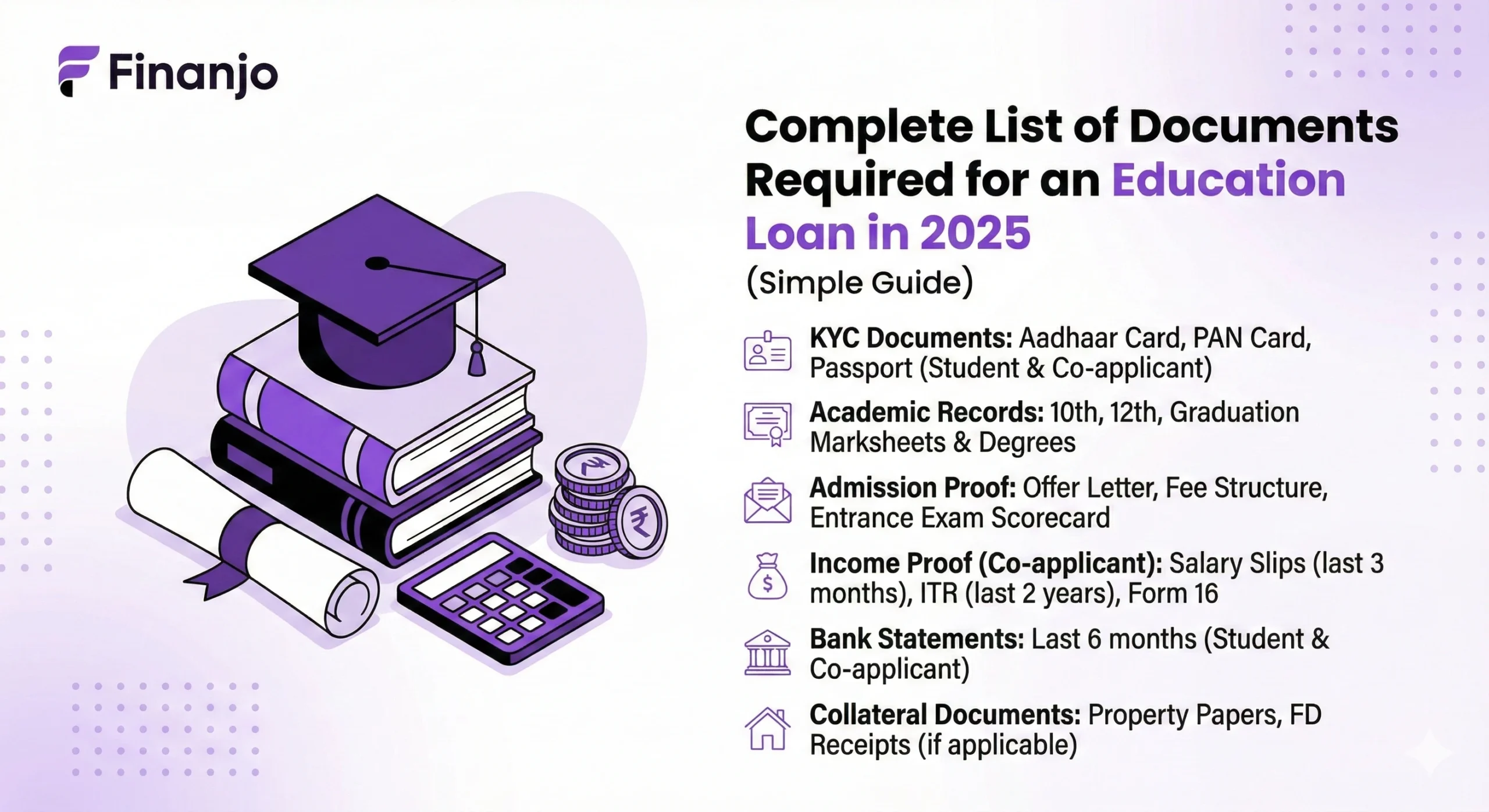

Complete List of Documents Required for an Education Loan in 2025

Understanding the documents required for education loan processing helps students and parents stay fully prepared and avoid last-minute delays. Below is the complete and updated list of documents banks and NBFCs typically ask for in 2025.

A. Student’s Documents

These documents help banks verify the student’s identity, academic eligibility, and admission status.

- Identity proof: Aadhaar Card, PAN Card, Passport, Voter ID

- Address proof: Aadhaar, utility bill, rental agreement, passport

- Academic records: 10th, 12th, graduation mark sheets, transcripts

- Entrance exam scores: JEE, NEET, CAT, GRE, GMAT, IELTS, TOEFL (as applicable)

- Admission letter: Official letter from the college/university confirming admission

- Fee structure: Detailed breakup provided by the institution

- Passport & Visa: Mandatory for study abroad programs

- Passport-size photographs: Usually 2–4 recent photos

B. Co-Applicant / Parent’s Documents

Co-applicants (usually parents) provide income and financial stability proof to ensure repayment capability.

- Identity proof: Aadhaar, PAN, Passport

- Address proof: Aadhaar, utility bills, passport, ration card

- Relationship proof: Birth certificate, Aadhaar linking, or family ID

- Income documents: Recent salary slips, Form 16, income certificates

- Employment proof: Employer certificate, ID card, or business registration

- Bank statements: Last 6–12 months showing stable financial behaviour

C. Financial / Income Documents

These documents help lenders assess the family’s financial strength and repayment potential.

- Income Tax Returns (ITR): Past 2–3 years

- Salary certificate / Form 16: For salaried individuals

- Bank statements: Demonstrating monthly inflow and ability to repay

- Business income proof: GST returns, balance sheet, profit & loss (for self-employed)

D. Collateral Documents (If Applicable)

These are required only for secured education loans, especially when the loan amount is high or for study abroad.

- Property documents: Sale deed, property registration papers

- Tax receipts: Property tax receipts

- Valuation report: Certified property valuation from an approved valuer

- FD/LIC policy papers: For fixed deposits or life insurance collateral

- Encumbrance certificate: Ensures the property is dispute-free

- Ownership proof: Documents showing the applicant legally owns the property

Academic Documents Required for Education Loan

All your past academic records must be submitted to the lender as proof of academic eligibility. Note that the UGC declared some universities as fake in recent years, meaning certificates from those institutions may not be valid for an education loan.

The following academic documents are usually required for a student loan:

| Academic Document | Conditions |

|---|---|

| 10th result | 50% or above pass |

| 12th result | 60% or above pass |

| Undergraduate results (final and/or semester-wise) | 60% or above pass |

| Entrance test results (GRE, GMAT, IELTS, TOEFL, Duolingo, SAT, ACT, etc.) | Minimum score as prescribed for the test |

| Proof of admission / Offer letter | Should be valid at the time of applying for a loan |

| Statement of cost of study / Schedule of expenses | Should document the major areas of funding for the loan |

| College / course prospects | If available |

| Copies of letters conferring scholarship, free-ship, etc. | If available |

| Gap certificate | Self-declaration from the student for any gap in studies |

Note: The above is a general list. You may not need every document, and in some cases additional, case-specific documents might be required.

Documents Required for Study Abroad Education Loans

When applying for an international education loan, lenders require additional verification to ensure the student’s identity, travel readiness, and university confirmation. Below is the list of essential documents for study abroad applicants:

- Passport: Valid passport for identity and travel verification.

- Visa copy: Student visa or visa application receipt (depending on the bank).

- University offer letter: Proof of admission from the foreign university or college.

- SEVIS fee receipt (USA only): Mandatory for U.S. universities to confirm student enrollment.

- Statement of Purpose (SOP): Sometimes used to assess your study plan and future potential.

- Accommodation proof: If you have booked a hostel or off-campus stay.

- Travel & living expense estimate: Helps banks calculate the total loan amount required.

These documents ensure banks clearly understand your study plans, expenses, and international requirements before approving the loan.

Bank-Specific Documentation Requirements (SBI, HDFC, ICICI, IDFC First, Axis)

Although most lenders ask for similar documents, some banks follow specific validation rules before approving an education loan. Here’s what you need to know.

Common Documents Across All Banks

- Student KYC and academic records

- Admission letter and fee structure

- Co-applicant KYC

- Income proof (salary slips, ITR, bank statements)

- Collateral documents (if applying for a secured loan)

Small Variations by Bank

- SBI:

- Strict property valuation norms

- Education loan checklist must be submitted in the correct order

- HDFC Credila:

- May ask for SOP and future income projection

- Faster digital documentation

- ICICI Bank:

- More emphasis on co-applicant income for unsecured loans

- IDFC First Bank:

- Simplified KYC; quick verification for salaried co-applicants

- Axis Bank:

- Requires updated 6–12 month bank statements with no major bounce history

Bank wise Comparison

| Bank | Collateral Requirement | Key Documents | Special Notes |

|---|---|---|---|

| SBI | Required for higher amounts | Property papers, valuation | Tight legal verification |

| HDFC Credila | Optional | SOP, admission proof | Study-abroad friendly |

| ICICI | Optional | Income proof, bank statements | Strong income needed |

| IDFC First | Mostly non-collateral | Basic KYC and income | Faster approval |

| Axis Bank | Optional | Statements, Form 16 | Clean bank history needed |

Education Loan Interest Rates 2025

| Bank Name | Interest Rate (% p.a.) |

|---|---|

| Bank of Baroda | 7.10% to 13.20% |

| Punjab National Bank | 4.00% to 12.35% |

| Canara Bank | 8.10% to 11.50% |

| Union Bank of India | 7.00% to 11.50% |

| State Bank of India | 7.55% to 10.65% |

| Central Bank of India | 8.55% onwards |

| IDBI Bank | 4.00% to 11.50% |

| Indian Overseas Bank | 8.25% to 12.50% |

| HDFC Bank | 10.50% onwards |

| Axis Bank | 9.58% to 12.75% |

| Federal Bank | 11.75% to 15% |

| ICICI Bank | 10.25% to 13.75% |

| Kotak Mahindra Bank | Up to 16% |

| Karnataka Bank | 9.00% onwards |

Tips to Avoid Loan Rejection Due to Documentation

Many education loan applications get delayed or rejected due to simple documentation errors. Here’s how to avoid them:

- Keep soft copies ready: Banks often ask for PDFs during online verification.

- Ensure name/address consistency: Mismatched spellings between Aadhaar, PAN, or passport can create delays.

- Submit updated bank statements: Make sure the statements show stable income and no large unexplained transactions.

- Verify property papers early: For collateral loans, property issues delay most applications.

- Avoid mismatch in income proof: Salary slips, ITR, and Form 16 should clearly support each other.

How to Organize Your Education Loan File

Organizing your loan file properly makes the evaluation process faster and more professional.

A. File Arrangement Order Preferred by Banks

- Student KYC

- Academic documents

- Admission letter and fee structure

- Co-applicant KYC

- Income documents

- Bank statements

- Collateral papers (if applicable)

B. Digital Folder Structure for Online Applications

Create separate folders named:

- 01_Student Documents

- 02_Academic Records

- 03_Admission & Fees

- 04_Parent Documents

- 05_Income Proof

- 06_Bank Statements

- 07_Collateral Documents

Ensure all documents are scanned clearly, labelled properly, and stored in PDF format.

Important information related to Educational Loan 2025

| Feature | Details |

|---|---|

| Loan Amount | Up to ₹50 lakh (domestic), ₹1 crore (abroad) |

| Interest Rate (Public/Private) | 4.00% – 16.00% |

| Interest Rate (RRBs) | 8.50% – 13.60% |

| Repayment Tenure | Up to 15 years |

| Moratorium Period | 6 months to 1 year post-course |

| Tax Benefits | Interest deductible under Section 80E (up to 8 years) |

| Collateral Requirement | Required for high-value loans |

| Eligible Courses | UG, PG, professional, diploma, skill-based |

How to Improve Your Eligibility for an Education Loan?

To qualify for an education loan, you must meet specific eligibility criteria. Here are some tips to enhance your eligibility:

| Method | Description |

|---|---|

| Maintain a Strong Academic Record | Consistently perform well in your studies and maintain good grades. |

| Score High in Qualifying or Entrance Exams | Achieve high marks in exams such as SAT, GRE, GMAT, or any relevant entrance tests. |

| Gain Admission to a Reputable University or College | Secure admission to well-recognized and accredited institutions, which increases your loan approval chances. |

| Demonstrate Strong Future Employment Prospects | Show potential for future employment in your field of study to assure lenders of your ability to repay the loan. |

| Present a Strong Financial Background | Ensure that your financial background or that of your co-signer is solid, demonstrating the capability to manage and repay the loan. |

FAQs about Education Loan documents

1. What if I don’t have a co-applicant?

Most banks require a co-applicant (usually a parent or guardian) for education loans. However, some NBFCs and international lenders offer loans without a co-applicant, especially for study abroad programs. These cases depend heavily on the student’s academic profile, university ranking, and future earning potential.

2. Can I get a loan without collateral?

Yes, you can. Non-collateral (unsecured) education loans are available from banks and NBFCs, especially for reputed colleges in India and abroad. Approval depends mainly on your co-applicant’s income, your academic merit, and the course/university you choose.

3. What if income documents are weak?

Weak income proof can delay or reduce your loan approval chances, but you still have options:

- Add a stronger co-applicant

- Use a guarantor

- Choose a collateral-based loan

- Apply through NBFCs that consider future earning potential more than income stability

4. Do NBFCs require fewer documents?

Yes. NBFCs generally have simpler and faster documentation processes than banks. They may not require extensive collateral papers or lengthy income proofs. However, interest rates can be higher, and repayment terms may be stricter.

Preparing the documents required for an education loan in advance can save you time, reduce stress, and speed up your approval process. From student KYC and academic records to co-applicant income proof and collateral papers, every document plays a key role in ensuring your loan is processed smoothly.

Being organized, keeping updated soft copies, and understanding what each bank requires will help you avoid delays or rejections. Whether you are planning to study in India or abroad, early preparation is the key to securing the right financial support.

As you apply for your education loan in 2025, stay confident, stay prepared, and take each step proactively. Your dream university is closer than you think!

Leave a Reply